💹 Bond Fund Performance: Active vs. Passive Investing

In our previous post, we examined the performance of US equity mutual funds over the past few years and found that most underperformed the S&P 500 and MSCI World ETFs. But what about US bond mutual funds?

📊 We analyzed a comprehensive dataset of US bond mutual funds, focusing on funds with the following characteristics:

💸 Taxable and municipal bonds

💰 Assets exceeding $300 million

🚫 Exclusion of closed-end funds and leveraged/inverse funds

We categorized the funds into Morningstar categories based on their investment style:

🏛️ Muni (all): 515 funds

📊 Intermediate Core Bond: 279 funds

💰 High Yield Bond: 170 funds

🔄 Intermediate Core-Plus Bond: 160 funds

📉 Short-Term Bond: 146 funds

🌐 Multisector Bond: 113 funds

🏦 Bank Loan: 74 funds

🔍 Ultrashort Bond: 61 funds

🛡️ Inflation-Protected Bond: 39 funds

🌍 Emerging Markets Bond: 39 funds

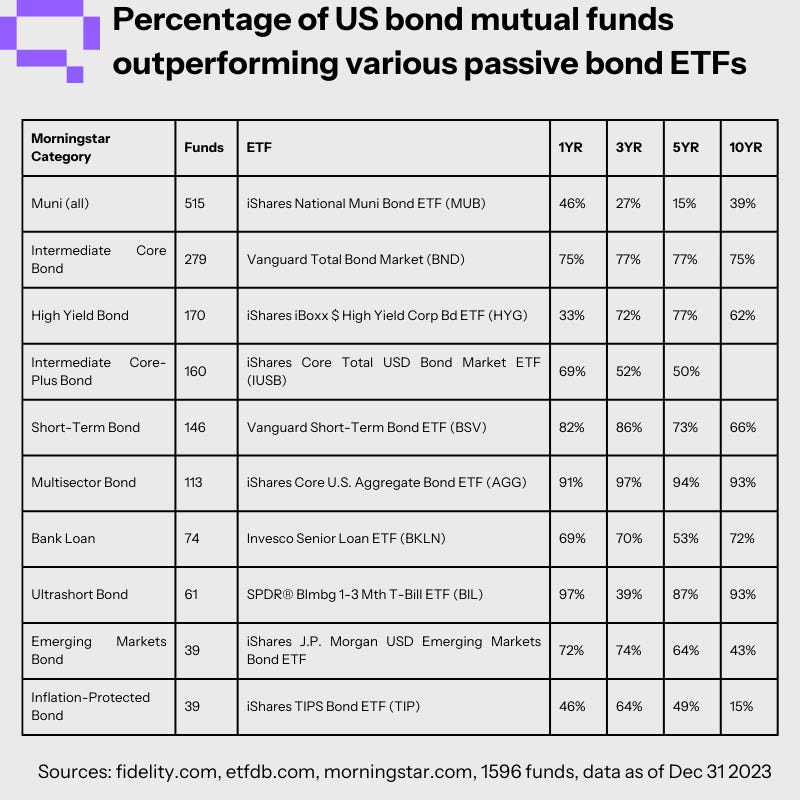

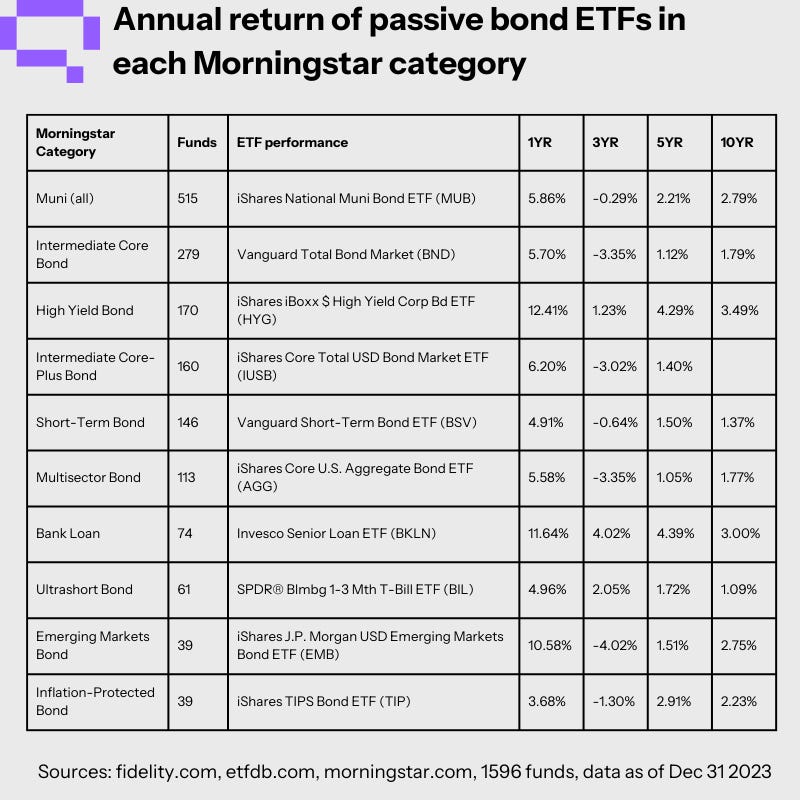

To provide a fair comparison, we selected ETFs that closely match each bond fund's investment style, are passively managed, have substantial assets, and have a history of at least 10 years. Only the Intermediate Core-Plus Bond category had an ETF with less than 10 years of history.

While our analysis revealed that passive ETF indexing generally outperformed equity mutual funds over the past few years, the results for bond funds were more nuanced. Actively managed bond funds demonstrated the potential to outperform their passive counterparts in certain categories.

Several factors may contribute to the outperformance of active bond managers:

💹 Pricing inefficiencies: while the S&P 500 contains 500 stocks the S&P US Aggregate Bond Index had 14 600 constituents at the end of 2023! The iShares Core U.S. Aggregate Bond ETF based on the Bloomberg US Aggregate Bond Index contains more than 11,000 holdings!

📉 Lower volatility: Bonds generally exhibit lower volatility than stocks.

🌐 Market size: new issues of fixed income reached 6.6 trillion dollars in the US in 2022 versus 87.1 billion dollars in equity, a bad year but still much lower than the bond market in any other year (source: 2023 SIFMA Capital Markets Factbook). This vast pool of new securities provides active managers with ample opportunities to identify mispriced assets.

📈 Bond market complexity: The bond market encompasses a wide range of factors, including sector, credit quality, seniority, collateralization, coupon, coupon type, maturity, optionality, and secondary market liquidity.

While passive bond ETFs offer several advantages, actively managed bond mutual funds and ETFs can be attractive options for investors who seek the potential for higher returns. However, it's crucial to recognize that consistent outperformance over multiple time horizons is challenging for any fund.

🔍 For more detailed insights, stay tuned! In our next post, we'll delve into the 2023 performance of Quantlake's classic systematic ETF portfolios (60/40, ESG 60/40, Warren Buffet, Ray Dalio's All Weather, etc).